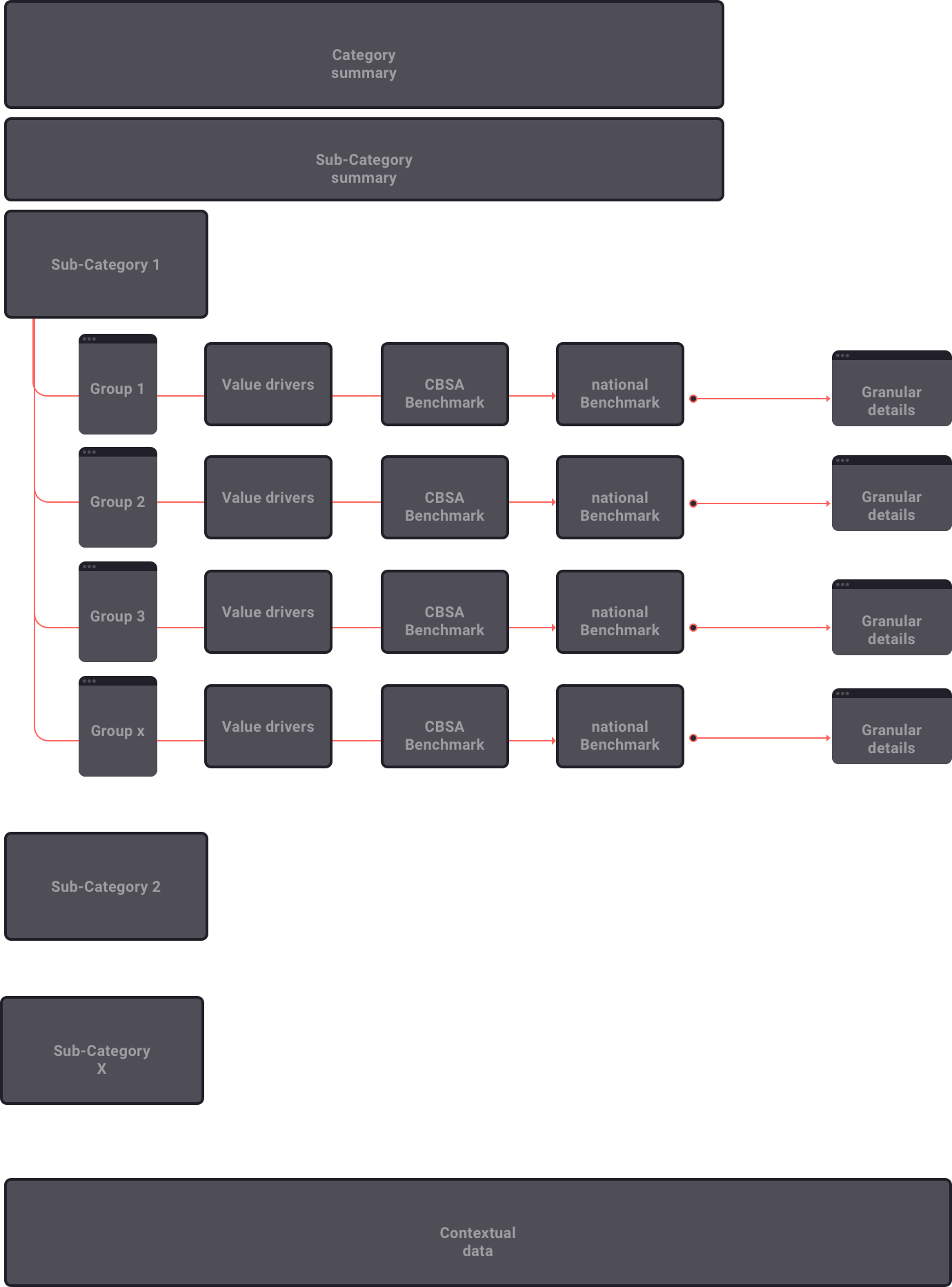

Information architecture

Understanding the market and the models

Being a complete novice to the market and to the models, a large part was simply to absorb and talk to lots of people, it’s also accepting that information is never complete and prepare for that in the design.

Design user flow around use case scenarios

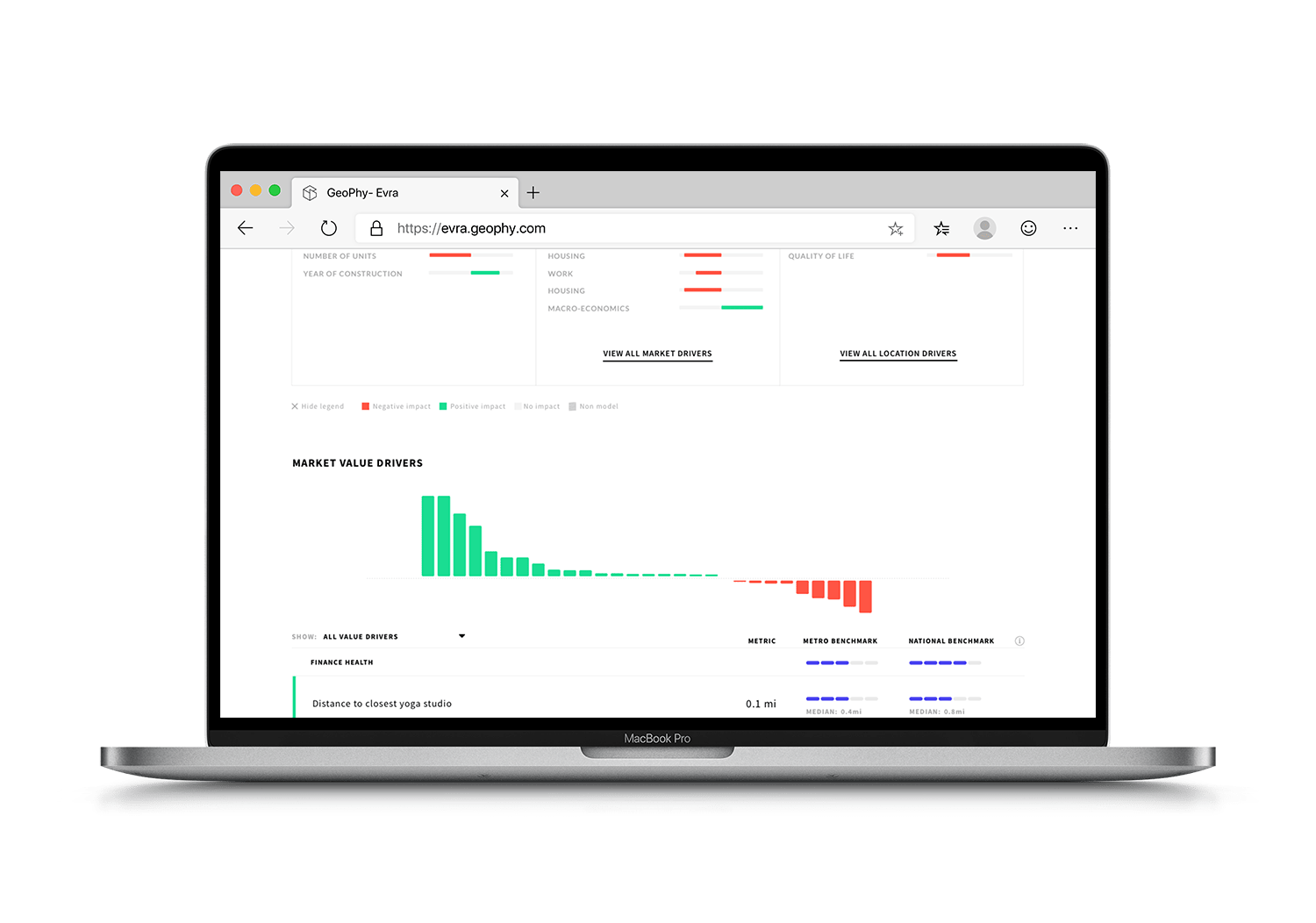

The architecture focuses on lowering adoption hurdle and display information by imitating an appraiser’s journey on valuating a property while adding additional macro values.

Give users what they are used to

With many variations and testing, I realised what works best is to give users what they are used to. The IA is rather flat as our users are used to printing the reports for documentation. Instead, the architecture shows layers vertically to help users navigate through the data pile. The data are shown in categories with benchmark data directly visible.